I will have to warn you its waste of time, but its kind of interesting to see how a well paid, "well respected" investor like Mr. Pimco seems to think that the solution to all the problems in the world is for the US Government to buy asset he is long - there is no talk of the small matter of funding this small exercise- only then notion that spending money is good.

I guess its the financial equivalent of "The boy with the Golden trousers (http://tinyurl.com/dnhqz3).......

I find its perplexing that in a time where we need everyone to think positively about solutions then Wall Street and its derivatives continues to look for ways of lining their pockets with state subsidised money. For the record Gross is even intellectually wrong: In order to stop the rot in the financial markets we need to reduce debt to equity not increase Mr. Gross.....

Only by governments taking the ultimate loss' on their plans/packages will we get the economy flowing again.....but do not let facts disturb your arguments.

I am just back from longer business trip to: France, Switzerland, UK and Dubai. Different parts of the business cycle obviously but everywhere there is now clear indication that the word CRISIS is well established, in the UK so much that in the local bookstore, they now have whole sections titled: Dealing with the Financial Crisis..sign of the times I guess.

From Davos I get same reports; everyone is reporting how negative everyone is but they are all taking this as an indication the low is in ? I never really understood these types of arguments: Why get the supposely smartest people in the world to meet up and talk openly about the economic affairs only to dismiss them ?

Anyway I am with Soros (as always). Read this great FT piece please, pretty please: http://tinyurl.com/cyq7rr - explains a lot of things even for simple people like me.

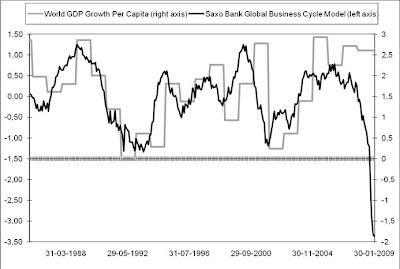

David Karsbøl, my Chief Economist, have updated his excellent leading indicator model for World GDP Growth per Capita and the result is NOT GOOD.. it looks like we could see - 2.0% this year - first time in history- so in other words - be my guest fade the facts and the smart guys, I hope it works - but as always hope belongs in Church.

(Click on chart for bigger version)

Why there may not be "bubble" in yields

Everyone and his brother is subscribing to the concept that yields are too low, especially in government bonds. (http://tinyurl.com/calo3u)

....but it's all based on the concepts off:- Fiscal & Monetary policy works

- Inflation

My firm believe remains that in times of rising unemployment levels everything becomes binary: its all ZERO and ONES.

If you lose your job you do not care where interest are going, what Bernanke thinks, What Obama does - No you want your job back and now!

Effectively right now we are in the path of the cycle where everything is ZERO's:

- Consumer confidence - 0

- Unemployment - 0

- Business margins -0

- Faith in banking system - 0

- Ability to maintain your job - 0

- Interest in Fed - 0

- Faith in Fed - 0

I think you get the picture - we got excess capacity in all business sectors, we got government busy printing & spending money not dealing with the problem, but getting reelected .......this is the true ingredients for deflation large -... meaning inflation will be ZERO at best minus 1% at worst(?).......

So now if monetary & fiscal policy have less tracktion plus DEFLATION....... a yield of 2.5% becomes 3.5% after inflation - I think it will compete very nicely with the return on the stock markets will considerable less volatility.This picture is even confirmed technically. Below is the 10y notes yield in the US - it looks to me like we are in the 4th wave - looking for 300 bps roughtly before we make it into new lows for bonds... this also finally matches the theory of Q1 being excessive in issuance. I have been wrong before and carry no predictability but for now I will keep most of my money in fixed income as the alternative cost analysis (i.e being long stocks...) still costs me money.

(Click on chart for bigger version)

Strategy:

85% in cash/FI - short eurusd and eurjpy.... looking for break of 800-ish to sell S&P... still target for S&P @ 650-690.Safe trading,

Steen

3 comments:

Steen, does the S&P target of 650-690 imply you're no longer looking for 600, or is this a tactical trade with a smaller target?

As always, thanks for sharing your thoughts.

MW

Actually - the only "minimum requirement" for the technical part of this position to follow the path most likely, would be to trade below 690-00 - the more obvious expected target being 600-650... as a move which goes too far first time - the scary ultimately game though could indicate even lower, but as always....for now I am merely looking at "bare minimum" but expecting Q4 could be worse.. i.e 2nd round lay-offs when the Obama and the "saving the world" packages fail to stem loss and increase lending.. I find Gross article simply .....too scary...

Sorry being so unclear

Steen - appreciate the analysis and find myself in agreement.

Post a Comment